A Message from

Eli Vazquez, CEO

A rewarding 2023 for our members

Giving Back in 2023

Recently, I was taking one of my periodic walks around the offices to chat with staff when I

noticed a calendar of inspirational quotes on the desk of one of the team members who is dedicated to

championing service to members. The calendar page featured a picture of a beautiful tiger leaping through

deep snow, and the caption beneath it read: “I am filled with boundless energy. I awaken each morning

eager for the new experiences to come.” The image and message resonated deeply with me and the

entire staff. With this boundless energy and enthusiasm, we are excited to roar into 2024!

As we begin 2024, I want to take this opportunity to highlight some of the milestones that made 2023 a

significant year of Bank-Fund giving back to the members and communities we serve. During the 76th year of

service to Bank-Fund member-owners, we continued building upon a solid foundation of strength and

stability. Bank-Fund is the 55th largest credit union among over 4,600 credit unions in the US, with

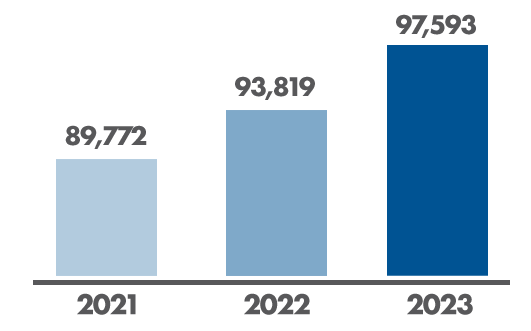

assets totaling over $6.2 billion. Bank-Fund membership increased by over 4%, reaching more than 97,000

members worldwide, and in 2024, we anticipate reaching an exciting milestone: 100,000 member-owners!

Number of Member-Owners

Despite a volatile economic environment, Bank-Fund stood strong, thanks to solid earnings, net worth, and

ample liquidity. While many financial institutions faced liquidity challenges, a prudent approach to

pricing, lending, and investing allowed Bank-Fund to weather the storm. We are proud of our steadfast

dedication to our principles, our practices, and our membership.

We believe in the cooperative spirit that drives the credit union movement, which is captured in the new

purpose statement: "To cultivate and enable shared prosperity through trusted financial

services." Through initiatives like Global

Rewards and Credit Card Rewards,

Bank-Fund was able to give back to members by offering outstanding dividends on the high-yield Premier Checking account, substantial discounts on loan

rates, and generous rebates on our already low fees. Over the course of the year, the interest rate on the

Premier Checking account nearly doubled and was recently raised again to the highest interest rate since

the inception of Global Rewards.

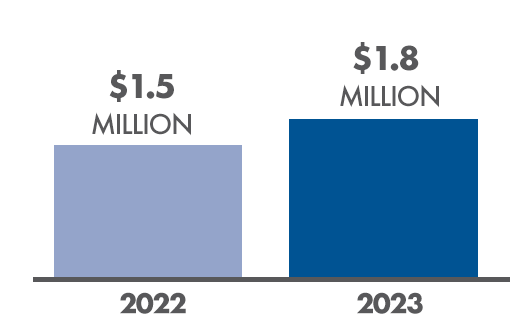

In 2023, members opened 4,579 premium 3-month and 6-month share certificates, for a total volume of more than $332 million. Over 95,000 Bank-Fund members are currently participating in Global Rewards and received over $1.8 million in fee rebates and cash rewards. Additionally, the Beyond Visa Signature credit card, already Bank-Fund’s most rewarding card, became even more rewarding in 2023. Cardholders earned 776 million points, thanks to the introduction of 5X points on air travel, 3X points on hotels and stays, 3X points on restaurants, 2X points on car rentals, and 1X points on other charges.

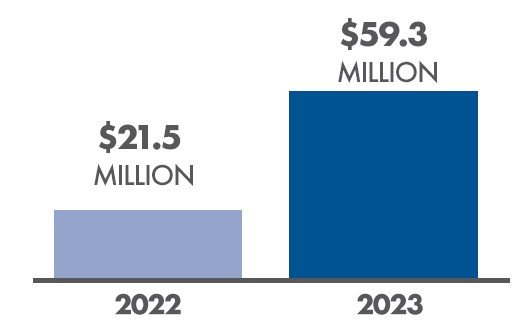

Total Dividends

Paid on Deposits

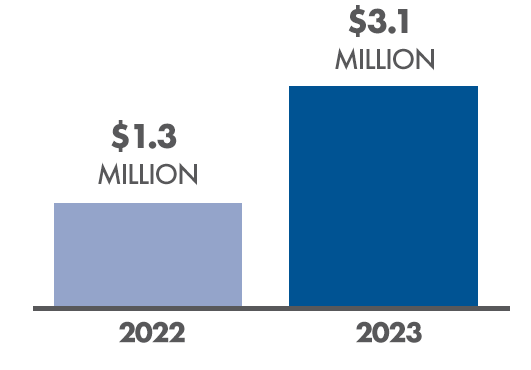

Premier

Checking

Account Dividends

Total

Global Rewards

Fee Rebates

Enhancing the member experience through digital technology remains a top priority. We introduced Live Chat, a feature of the digital banking platform that connects members to support staff via a dedicated chat screen and enables them to seamlessly switch to a phone or video channel during the same conversation. Live Chat also features a "virtual assistant” that leverages automation to provide 24/7 assistance to help members quickly find answers to their questions.

Visiting BFSFCU.org now offers members a new and improved website featuring several key enhancements,

including tabbed browsing for easy navigation, optimized search to help members quickly find what they’re

looking for, and a new suite of helpful financial calculators.

Recognizing that members rely on Bank-Fund for advice, resources, and solutions to help them make

informed financial decisions, we offered multiple opportunities for member education and financial

wellness. Last year, Bank-Fund hosted 57 webinars covering a wide range of topics, from cybersecurity to

income tax reporting to estate planning, that were tailored to the needs of the sponsor groups.

A commitment to giving back remained firm on a community level as we supported organizations and the local community, including the MMEG, Habitat for Humanity, Children’s Miracle Network, and more.

A closer look at how we gave back to our

member-owners in

2023*

As I reflect on the past year and all we have accomplished in service to Bank-Fund’s member-owners,

I find myself inspired by the achievements and filled with boundless energy and enthusiasm for the year

ahead. On behalf of the Bank-Fund team and Board of Directors, I thank you for your continued loyalty to

the cooperative, and wish you and your family a happy, healthy, and prosperous year!

Eli

Vazquez

CEO

*As of 12/31/2023