Share Certificates

A secure investment that can offer you higher returns on your savings.

Open a Certificate Check Rates

View our competitive certificate rates!

6-MONTH

JUMBO

3.75% APY*

12-MONTH

CERTIFICATE

3.00% APY*

5-YEAR

HIGH YIELD

3.00% APY*

There are many benefits to choosing our certificates

Great

Rates

Watch your

balance grow

with our

impressive rates.

Guaranteed

Returns

A secure way to grow your

savings.

Terms to Meet

Your Needs

Choose terms ranging from

6 months to

10 years.

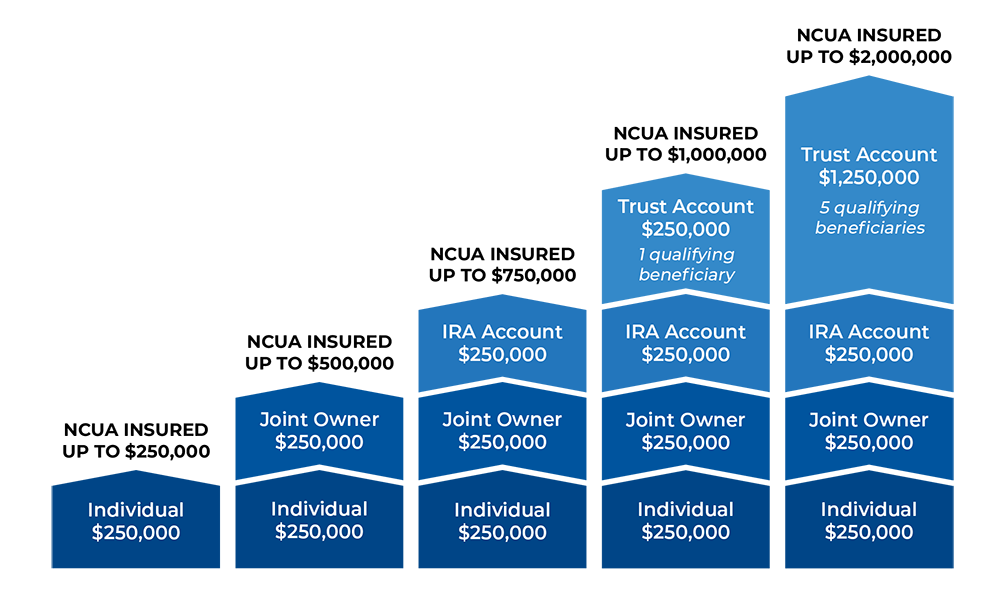

NCUA

Insured

Your deposit is Federally insured

up to at least $250,000

by

NCUA.

Open Your Certificate Today

Log in to Digital Banking and click on Self Service to open your Certificate.

Resources to help your money work smarter for you!

Certificates Laddering Strategy

Learn how to maximize your savings with this strategy to get higher yields and sufficient access to your cash.

Building a Savings Cushion

Having a savings cushion can provide financial peace of mind and a source of funds if you need them.

Make your Money Work Harder

Your money is an asset, and it should work hard for you in the same way you work hard to earn it.

Your Savings are Safe

Your savings are insured by the NCUA (National Credit Union Administration), an agency of the federal government, and the administrator of the NCUSIF (National Credit Union Share Insurance Fund). Your savings are protected up to at least $250,000 per individual depositor, or it could be more based on account ownership and structure. Visit our NCUA Share Insurance page to learn more.